An essential consideration while availing a home loan is the EMI. Being a long-term commitment, home loan EMIs can run for several years. A correct estimation of your home loan EMI helps you plan your finances, which helps in easy repayment.

In this article, we will tell you how you can calculate your home loan EMI with the help of an EMI calculator and its various advantages.

Formula to Calculate Home Loan EMI

You can calculate the applicable home loan EMI with this formula:

EMI= P x r x (1+r) n/((1+r) n-1) where:

- P = Principal amount

- R = Home loan interest rate

- N= Number of months in the loan tenor

However, manual calculation of the EMI amount using this formula is not only tedious and cumbersome but also leaves ample scope for errors. This is where a home loan EMI calculator comes in handy.

How to Use a Home Loan EMI Calculator?

Using a home loan calculator is simple. All you need to do is to input the values in respective fields as outlined in the calculator and within seconds, you will know the EMI amount. You need to feed in the following in the calculator:

- Loan amount

- Tenor

- Rate of interest

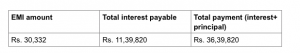

Upon doing so, not only you will know the EMI to be paid every month but also the total interest payable and the overall payment including principal and interest. Let’s see the EMI amount, total interest and the overall payment you will make if you avail a home loan of Rs. 25 lakh for a tenor of 120 months at 8% rate of interest.

Advantages of Using a Home Loan EMI Calculator

- Easy to use

This is the foremost benefit of using a home loan EMI calculator. It simple and easy to use. You need to fill up three fields outlining the loan amount, rate of interest and tenor. The calculator does the rest for you.

- No chances of errors

When you use a home loan EMI calculator, the chances of going wrong with EMI calculation is almost nil. This is a big advantage as you will know the exact EMI you need to shell out towards your home loan. Accordingly, you can plan other commitments and ensure that the current ones are on track.

- Break-up for easy understanding

Most online home loan EMI calculators not only tell the EMI amount but also the total interest payable along with the total payment you will make at the end of the loan tenor. Having these figures will help better plan your finances so that you can easily meet other commitments. The higher the loan tenor, the greater the interest outgo and vice versa.

- Easy to reset

A home loan calculator is easy to reset. You can change the loan amount, rate of interest, loan tenor and the calculator throws up results accordingly. So, in case of any error, you can rectify it easily.

Note that while the loan amount and the rate of interest has a say on the EMIs payable, the loan tenor plays an equally important role. The higher the tenor, the lower is the EMI and vice versa.

Availing a Home Loan at a Competitive Rate of Interest

If you are looking for a lender who offers a competitive home loan interest rate, you can approach NBFCs. You can avail the best home loans schemes up to Rs. 5 crores with flexible tenor ranging up to 240 months. The competitive interest rate ensures your EMIs are well within your budget.

You also get a customized report that guides you through all legal and financial aspects of home buying. Easy home loan eligibility coupled with minimal documentation helps in seamless access to the required funds. Also, no charges on part prepayment and foreclosure make this loan quite affordable.